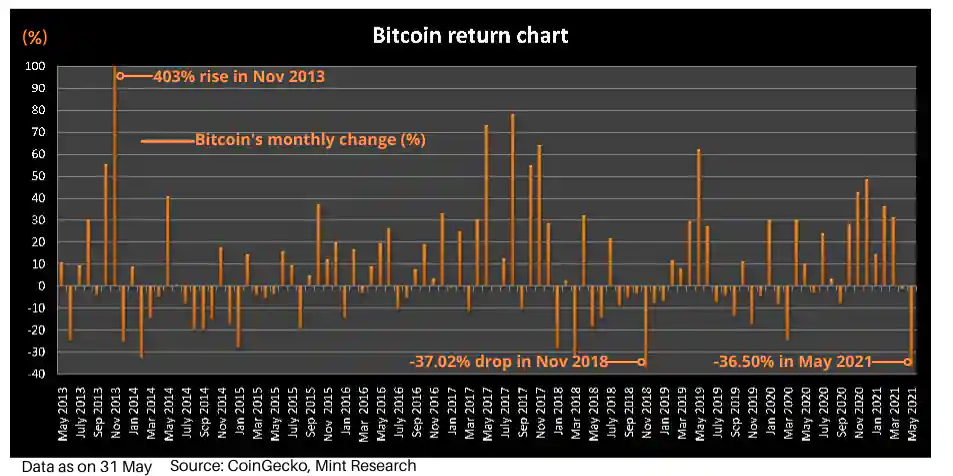

NEW DELHI: With a drop of 36% in May, Bitcoin has posted its worst fall since November 2018 as lofty valuations, concerns over its environmental impact and a regulatory crackdown on cryptocurrencies in China took a toll. Moreover, Bitcoin’s fall last month is the second-biggest since May 2013, as per data available with cryptocurrency tracker CoinGecko.

The bearish factors for bitcoin during the month included higher-than-expected inflation data in the US, Tesla chief Elon Musk announcement that the company will no longer accept bitcoin payment, criticism surrounding Tether’s reserves, news that Binance is under investigation by the US Department of Justice and China reiterating its ban on financial institutions from participating in crypto.

From the level of $57,829 at the beginning of May, the world’s biggest cryptocurrency closed at $37,341, logging a fall of 36%. The digital asset had recovered from a low of $30,000 during the month and hit a high of over $40,500 last week but failed to sustain at that level.

View Full Image

The Bitcoin market has become a battleground between bulls and bears, and the key question on investors’ minds is what’s next?

Fundamental view

During 14-20 May, when Bitcoin slumped close to 47%, investors had booked losses of $14.2 billion. According to an on-chain report from Glassnode, an all-time high of $4.53 billion in losses were booked on 19 May and $14.2 billion for the week.

The report also highlighted that a large portion of the recent selling activity was driven by short-term holders, those owning coins purchased within the last six months.

Despite the recent bump, bitcoin has rewarded long-term investors with a year-on-year growth of 278%.

“The current consolidation in prices is healthy from a short-term perspective and can be used for fresh entry into the crypto assets. It should be noted that bitcoin has the largest market capitalization amongst peers by virtue of its technological advantage and global acceptance. Any developments in these aspects would act as a trigger for the short term and hence investors should remain cautious. Investors with a long-term holding period can remain invested with an appropriate stop-loss,” crypto exchange CoinDCX said.

Technical view

Bitcoin is currently trading in a range in the shape of a narrowing wedge. According to a note by ZebPay, a breakout above the top of the wedge could result in further upside momentum. “A breakout below could lead to a retest of the recent lows around $32,000. Resistance on the upper end may be found around $44,000,” the note added.

View Full Image

From medium-term perspective, Zebpay said that as seen on the global BTC-USD chart, in the intermediate time frame, shown on the daily price chart, bitcoin price…

Read more:Bitcoin logs worst monthly fall in nearly three years in May: What’s next?