Weekly Technical Trade Levels on USD Majors / Commodities

US Dollar Rally Extends into Key Resistance ahead of FOMC as Gold, Silver Probe Support – Bitcoin, SPX Threaten Larger Breakdowns

The US Dollar surged more than 1.6% off the monthly lows with a breakout of the monthly opening-range taking price into the first major resistance hurdle a the yearly high-day close at 93.45- the bulls are vulnerable near-term while below this threshold. Correspondingly, Euro is probing key support at 1.1694-1.1706 early in the week an we’re looking for possible price infection across numerous USD Majors.

On the commodity side, the gold sell-off is testing downtrend support a the June lows near 1750 and while we could see some recovery in the near-term, the risk remains for a test of critical support at 1729/38. A break of uptrend support in Bitcoin also threatens a larger decline in cryptocurrencies with BTC/USD now testing the monthly range lows – the risk for a deeper pullback remains while below the monthly open at 47123. In this webinar we take an in-depth look at the key technical trade levels for US Dollar Index,EUR/USD, GBP/USD, USD/CAD, AUD/USD, NZD/USD, Gold (XAU/USD), Silver (XAG/USD) , Crude Oil (WTI), Bitcoin (BTC/USD), SPX500, USD/CHF, AUD/JPY and USD/JPY.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

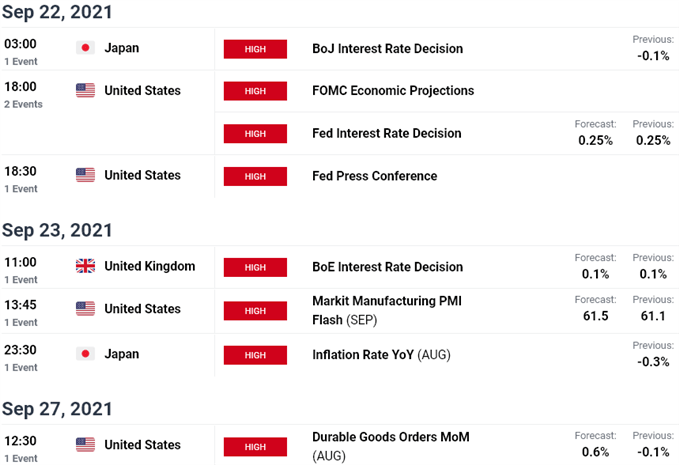

Economic Calendar

Economic Calendar - latest economic development and upcoming event risk

—Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex

Read more:Technical Setups: USD Majors, Gold, Oil, SPX & Bitcoin ahead of FOMC