In 1940, the chances of children outperforming their parents in terms of income was 41%. In 1980, this decreased to 8%, according to Opportunity Insights. Given the current inflation trajectory followed by wide-scale suspension of economic activity throughout 2020, it seems likely that social mobility compared to previous generations will continue to decline.

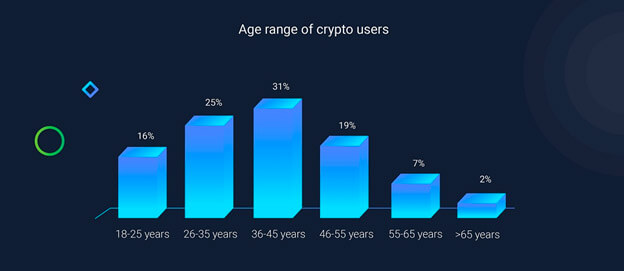

One way in which this trend can be combated is through investing in deflationary assets – such as some cryptocurrencies. Unsurprisingly, younger generations, led by millennials, are at the forefront of crypto adoption.

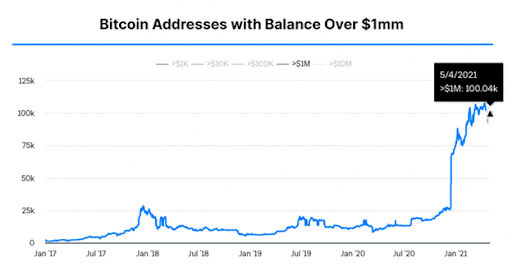

There are many ways one could invest in such digital assets. The most passive way is to simply buy an asset, hold it, and hope to sell it when its value doubles, quadruples, or beyond. This form of investment, which is based largely on timing, minted many crypto millionaires. In May of 2021, there were about 100,000 BTC addresses with over $1 million worth of Bitcoin.

Seeing such a rapid rise in wealth of so many, there’s no wonder why some retail traders now view the crypto market as a get-rich-quick scheme. Within this mindset, one of the more active investment methods to use is margin trading, drawing its root all the way back from the late 1800s as a way to bankroll railroads. As we fast-forward over 120 years, let’s take a look into how margin trading works in the crypto space.

What Is Margin Trading?

Margin trading is leveraging your market position to reap greater rewards with a small initial investment. This is possible by adding a collateral called margin – the funds you borrow from a third party (brokerage or exchange) – to your trade. However, in the same way your leverage can bring about X times profits, it can also incur devastating losses if the asset’s price defies your expectations.

In practice, if you were to margin trade $50 worth of BTC for a 5X leverage, you would borrow $200 to buy $250 worth of Bitcoin (BTC). Therefore, your effective trade with which you would enter the market would be at $250 instead of $50. In turn, no matter how the trade pans out, you would have to return $200 + the platform’s fees.

If a crypto’s price move goes wrong – down instead of up since you entered your position – the crypto exchange will “margin call” your trade when the price hits a level when you start losing borrowed funds. To avoid getting margin calls, and having your trade turn into a loss, you would have to keep adding funds above that level.

When you bet that the crypto’s price will go down, you enter a short position. Correspondingly, when you bet that the crypto’s price will go up, you enter a long position. In the crypto space, margin trading is especially risky because crypto assets are inherently volatile. After all, they all hold relatively low market capitalizations (compared to the traditional stocks, that is) which makes it more likely that crypto whales can move prices to their…

Read more:Beginner’s guide to margin trading cryptocurrencies | CryptoSlate