Bitcoin took a breather on Tuesday after a near-20% price rally over the past few days. The cryptocurrency declined from $40,000 resistance as Amazon denied rumors it will accept bitcoin payments. Bitcoin was trading around $37,000 at press time and is down about 4% over the past 24 hours.

Technical data suggests lower support around $34,000 could stabilize the current pullback.

“Going forward, we expect bitcoin to keep pushing higher and test the upper end of the $30,000-$42,000 trading range,” wrote Pankaj Balani, CEO of Delta Exchange, in an email to CoinDesk. “We expect to see similar moves in altcoins, too, led by ether.”

Latest prices

- Bitcoin (BTC) $37,896.6, -3.95%

- Ether (ETH) $2,244.3, -4.27%

- S&P 500: 4401.5, -0.47%

- Gold: 1799.2, +0.1%

- 10-year Treasury yield closed at 1.238%, compared with 1.293% on Monday

“Only a conclusive break above $50,000 in BTC would attract fresh flows and signal a change in the broader direction for the market,” Balani wrote.

Some analysts expect further upside in bitcoin as institutional buyers find value opportunities across cryptocurrencies.

“As institutional investors have been waiting on the sideline to take positions, the current market move could be sustained during the week” wrote Elie Le Rest, partner at crypto hedge fund Exo Alpha, in an email to CoinDesk.

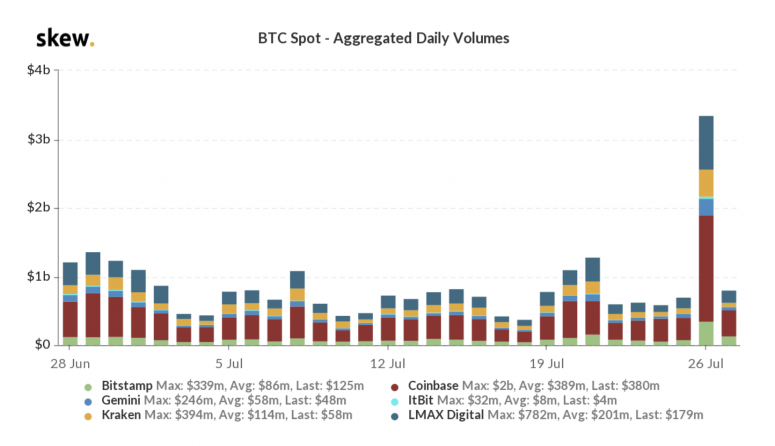

The short-squeeze rally triggered the most active trading session this quarter in crypto markets, according to data from Skew.

The increase in volumes has been driven by large buyers, typically institutions that have waited for a more directional trend on bitcoin since the end of May, according to Le Rest.

Brief return to profitability

“This indicates that 11.2% of the circulating supply has an on-chain cost basis between $29K and $38K,” Glassnode tweeted Monday.

Bitcoin drawdown

Bitcoin’s drawdown, or the percentage decline from the peak near $63,000, narrowed to around 40% over the past week. Typically, drawdowns exceeding 50% indicate the start of a bearish trend, similar to 2014 and 2017-2018.

The current drawdown suggests bitcoin’s intermediate-term downtrend is stabilizing given the sharp price bounce over the past few days. However, drawdowns can last much longer towards 70%-80%, which previously occurred near bear market troughs.

Options less bearish

Bitcoin’s one-month put-call skew, which measures the cost of puts, or bearish bets, relative to calls, or bullish bets, has come off sharply to 2% from 13% late last week, according to data provided by crypto derivatives analytics firm Skew. The one-week put-call skew has declined from 13% to 5%.

The narrowing of the spread between prices for puts and calls essentially means investors are no longer…

Read more:Market Wrap: Bitcoin Stalls After Short-Squeeze Rally - CoinDesk