We spoke to thought leaders from Advanced Markets, FXOpen, and Equiti Capital to ascertain their view on what was behind last month’s crash as it is unlikely to be the last.

It’s June. We’re past the May market crash that took many crypto traders by surprise (and panic). As we enter the weekend, the only market that is open 24/7 gets all the attention.

With most cryptocurrencies being in the red today, we decided to review the crypto crash of last May and confirm that the trading industry is flocking towards the new asset class for the same reason the market took a temporary beating: volatility.

Bitcoin alone saw traders liquidating approximately $12 billion in leveraged positions in the last week of May, with about 800,000 crypto accounts being blown in the process, according to bybt.com.

As it usually happens in highly leveraged markets, upward movements get boosted, but the same happens on downward spirals. Selling begets more selling until the system finds an equilibrium.

From their highs, the largest cryptos by market cap (according to coinmarketcap.com) – excluding stablecoins – tumbled fast and hard.

Bitcoin (BTC) fell from 65,000 to 30,000, while Ethereum (ETH) plunged from 4380 to 1732, Binance Coin (BNB) dropped from 692 to 212, Cardano (ADA) went from 1.77 to 1.26, Dogecoin (DOGE) tumbled from 0.74 to 0.22, Polkadot (DOT) bled from 49.75 to 13.81, and Polygon (MATIC) went on a free fall from 3 to 0.75.

Ripple’s XRP comes in as a particularly interesting case. The cryptocurrency XRP lost two-thirds of its value, from 1.96 to 0.65, in a moment when most exchanges decided to restrict the trading of the instrument for the time being on account of the SEC v. Ripple lawsuit.

Ever since the complaint was filed in late 2020, the Securities and Exchange Commission has been confronted by angered XRP holders, who feel their rights are not being protected. John E. Deaton, the lawyer for the XRP holders who have filed a motion to intervene in the court, has even suggested holders – or investors, depending on the answer to “Is XRP a security?” – are being targeted by the SEC.

So, with crypto exchanges blocking the trading of XRP, volumes should probably get thinner. As it turns out, XRP is the fourth most traded digital asset on Kraken (an exchange that also halted the trading of XRP in the United States) and other venues.

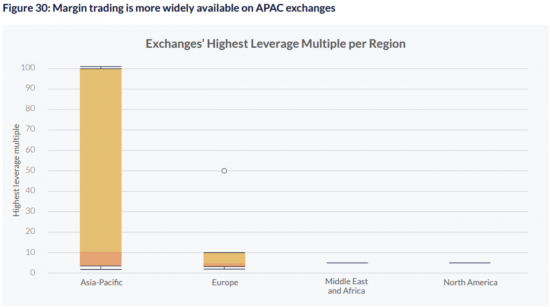

This is the result of margin trading in cryptocurrencies, which is particularly predominant in Asia Pacific jurisdictions. According to a 2021 Cambridge University Crypto Asset Benchmarking Study, APAC exchanges offer considerably greater leverage.

“While this allows for greater gains in speculative trading, it also accelerates losses exponentially”, said Natallia Hunik, Chief Revenue Officer at Advanced Markets.

“The type of volatility that we see in crypto assets is non-customary where traditional financial instruments are concerned so, given the combination of lower liquidity than traditional assets and…

Read more:Crypto Crash: Experts weigh in as leverage drives market both ways, including XRP -