Bitcoin rose 7%, reversing the past few daysâ losses, as some blockchain data turned bullish and new signs emerged of increasing cryptocurrency acceptancer by Wall Street firms including Goldman Sachs, Citigroup and Fidelity Investments.

- Bitcoin (BTC) trading around $48,593.99 as of 21:00 UTC (4 p.m. ET). Climbing 8.10% over the previous 24 hours.

- Bitcoinâs 24-hour range: $44,874.92-$49,520.72 (CoinDesk 20)

- BTC trades above its 10-hour and 50-hour averages on the hourly chart, a bullish signal for market technicians.

Bitcoin prices surged 36% in February, marking the cryptocurrencyâs fifth consecutive monthly price increase, the first time thatâs happened since mid-2019. A six-month stretch of gains hasnât been seen since the period of November 2012 through April 2013.

So the odds might seem stacked against a monthly gain in March, which would match the seven-year-old streak. But the first day of March pushed bitcoin in that direction amid signs that more big institutions are moving into cryptocurrencies.

A top executive for the giant U.S. money manager Fidelity Investments compared bitcoin with gold, and the investment bank Goldman Sachs said it will relaunch its crypto trading desk after a three-year hiatus. Citigroup, one of the biggest U.S. banks, wrote that bitcoin was at a âtipping pointâ as more institutions adopt the cryptocurrency.

Google Finance added a data tab on cryptocurrencies. And Michael Saylorâs MicroStrategy, which has been a big bitcoin buyer for its corporate treasury, added another $15 million worth.

Read More: Fidelityâs Head of Global Macro Says Bitcoin May Have Place in Some Portfolios

Bullish blockchain data

The sudden move higher following last weekâs 21% plunge â the biggest market correction since March 2020 â was foretold by some traders and analysts who were seeing increasingly bullish signs in blockchain data.

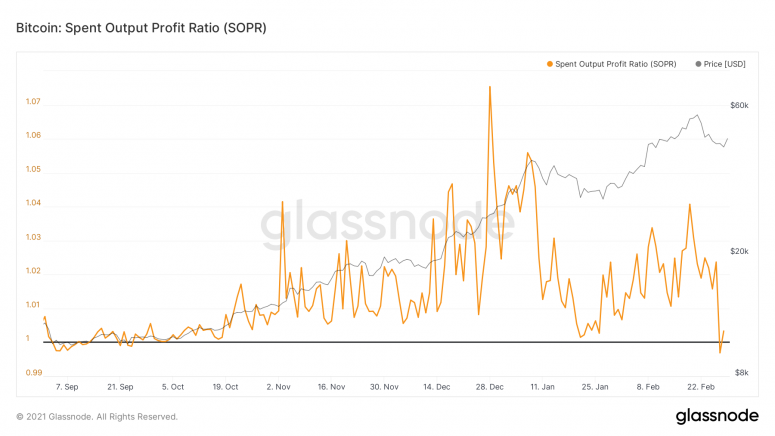

One such indicator, the spent output profit ratio (SOPR), represents the profit ratio of coins moved on the blockchain. If the metric is above 1, that means most holders could sell their bitcoin at a profit. But when it slips below 1, more traders would be selling at a loss, seen as unsustainable since many holders are reluctant to accept anything but profits.

And the metric dropped below 1 on Saturday for the first time since last September, according to data from Glassnode. The implication is that investors would refuse to sell until prices rose.

Read more: Why $1 Million Bitcoin Is Coming

âThe SOPR metric has been reliable for ïżœ?buy the dipâ opportunities in bull markets,â Norwegian blockchain firm Arcane Research wrote in a tweet on Monday.

âIn a bull market, investors are more inclined to take profit until the stop-profit point and refuse any stop-loss orders,â crypto analytics account BeatleNews on Chinese-language based social media platform Weibo, wrote in a post Sunday night, âWhenâŠ

Read more:Market Wrap: Bitcoin Faces Long Odds in Bid for Sixth Straight Monthly Gain -