Everyone’s pinning their hopes on this new year to bring good fortune,

and for Bitcoin traders, it couldn’t be a better beginning. January saw BTC

soar to dizzying new heights of up to $40,000 per coin. While the market has seen some price activity since then, it looks like BTC will hold the high

ground.

After the economic turmoil of 2020 and increased adoption of Bitcoin by mainstream financial institutions, the first cryptocurrency is close to living up to its nickname of ‘digital gold’.

How Did We Get Here?

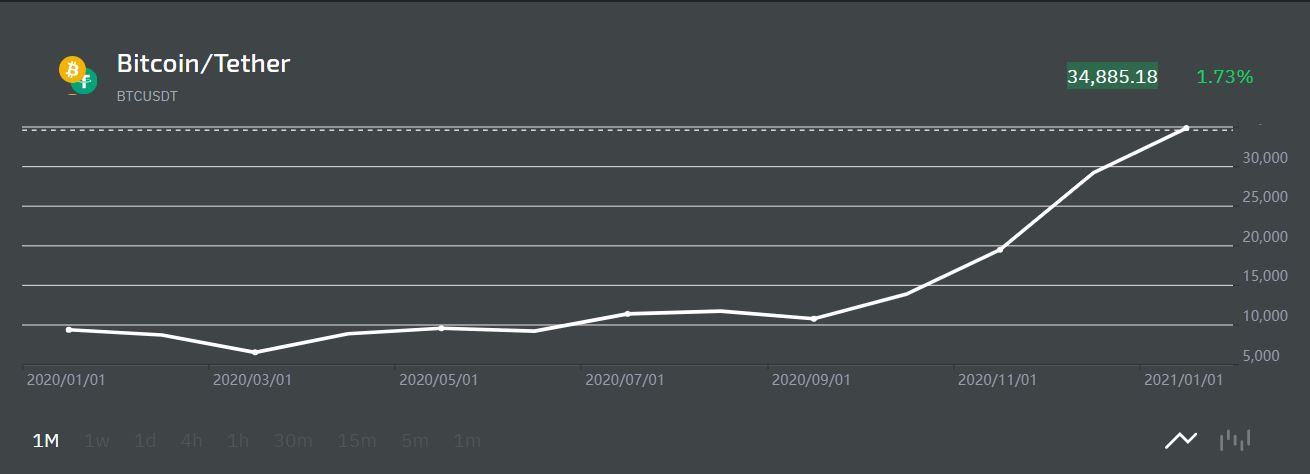

Bitcoin’s triumphant volatility may have surprised some market followers

that saw Satoshi’s creation dip as low as $4,000 in the spring. But, as the

global economy continued to suffer due to the COVID-19 pandemic, large-scale stimulus packages from state actors meant that traditional fiat currency was at risk of devaluation. On top of that, the 2020 halving event cut down rewards from miners, making the asset’s already limited supply even more scarce.

Investors took note, and the cryptocurrency became more and more

attractive for speculators looking for a hedge against inflation, with Goldman Sachs identifying Bitcoin as ‘digital gold’ and Paul Tudor Jones endorsing it as well. Grayscale, Fidelity, MassMutual and Microstrategy have all gained exposure to Bitcoin recently.

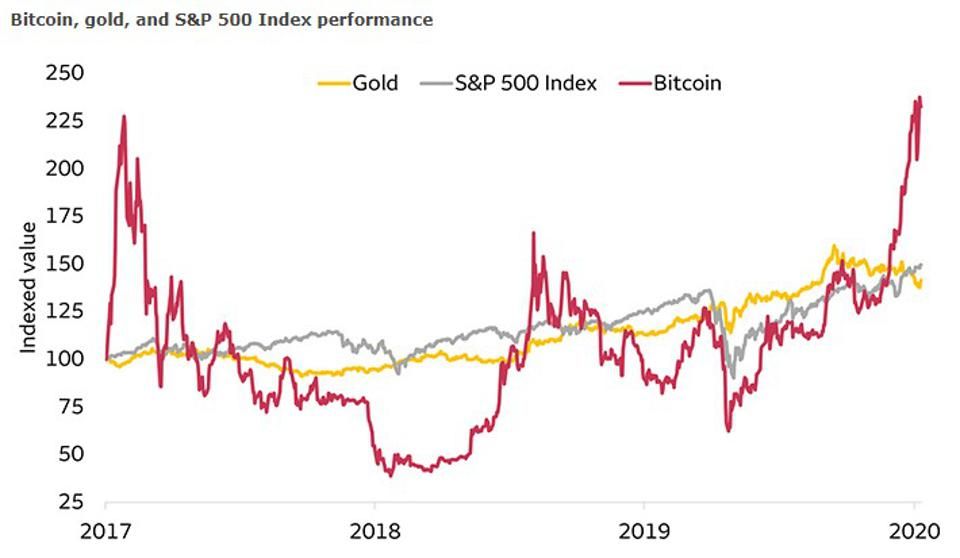

BTC outperformed gold and the S&P 500 in recent years, but with higher volatility. / Wells Fargo.

The institutional investment in BTC is still a relatively small percentage of the market, but individual investors have benefited from mainstream interest via higher value for their holdings. Square ($50 million invested

in Bitcoin) and PayPal — which recently added BTC and other cryptocurrencies to its service — are delving into the Bitcoin world. As more platforms explore BTC, its value as a digital asset will be sure to reflect its use cases beyond that of a speculative asset.

The combined value of Bitcoin and the rest of the cryptocurrency market

surged to over $1 trillion as prices rose across the board. But BTC’s recent

climb couldn’t last forever.

BTC Market Right Now

At the time of writing, Bitcoin (BTC) price slipped for the fourth day in a row. However, at $35,000, it bounced back from a recent drop to $30,000 and is still far above 2020’s low of $3,800.

Savvy analysts have pointed out that both BTC’s trading volume and active address are at a new all-time high. Meanwhile, several firms have reported a dramatic rise in Bitcoin futures contracts, and online crypto exchanges have noted an influx of new users.

BTC’s recent performance: starting 2021 on a high note.

More BTC is changing hands than ever, a sign of a healthy, liquid market. Bitcoin’ whales’, or accounts with more than 1,000 BTC, are also on the rise, potentially gobbling up the smallest retail investors (less than 0.1 BTC) who panicked and sold during the dip.

Outlook for Bitcoin in 2021: Should You Invest?

Many analysts, institutional investors and crypto specialists alike predict sunny outlooks for Bitcoin over the…

Read more:The 2021 Digital Gold Rush for Bitcoin | Hacker Noon